Inside the AI Chip Money Loop: How OpenAI, Nvidia, AMD, and Oracle Are Reshaping the Global Tech Economy

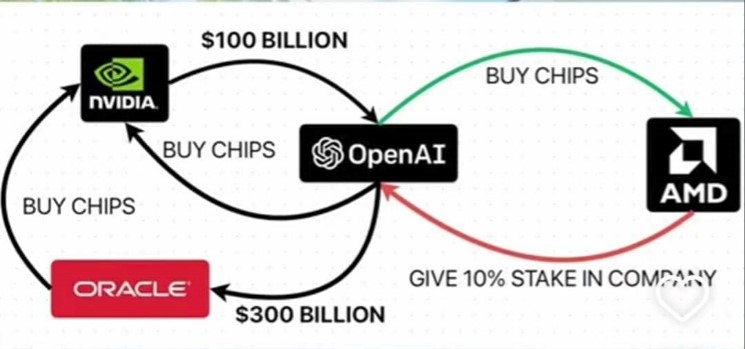

OpenAI’s explosive growth has been fueled by massive new partnerships with chipmakers and cloud providers. For example, Nvidia agreed in Sept 2025 to invest up to $100 billion in OpenAI in exchange for supplying at least 10 gigawatts of new GPU computer. AMD meanwhile signed a multi-year deal in Oct 2025 to deliver up to 6 GW of its Instinct AI GPUs to OpenAI (starting 2026) and granted OpenAI warrants for up to 160 million AMD shares. Oracle partnered with OpenAI to build 4.5 GW of new “Stargate” data-center capacity (reportedly a ~$300 billion commitment). Microsoft (OpenAI’s lead investor) maintains its 27% stake and Azure exclusivity while Amazon/AWS has signed a ~$38 billion cloud services deal and is reportedly in talks to invest ~$10 billion and supply its Trainium chips to OpenAI. These blockbuster deals dwarf typical tech contracts – collectively pushing the AI infrastructure market toward the trillion-dollar scale.

- Nvidia–OpenAI: In September 2025 Nvidia announced it would invest up to $100 billion for non‐voting OpenAI shares and a commitment to supply at least 10 GW of new GPUs. The deal ties Nvidia’s latest “Vera Rubin” GPU platform to OpenAI’s next-gen models, and triggered a stock jump as high as 4.4% for Nvidiareuters.com. Analysts immediately noted the circular investment nature: Nvidia’s funds flow to OpenAI, which then buys Nvidia’s own chips. This is efficient if demand is real, but critics warn it can artificially inflate revenues and valuations.

- AMD–OpenAI: In October 2025 AMD unveiled a 6 GW GPU supply deal with OpenAIir.amd.com. The agreement includes warrants letting OpenAI buy up to 160 million AMD shares (~10% of AMD) at $0.01 each, vesting as OpenAI reaches deployment milestones and share-price targetsir.amd.com. AMD’s executives project “tens of billions of dollars” in revenue from this dealir.amd.com, and the announcement sent AMD stock soaring (up 34% in one day)reuters.com. Analysts call it a vote of confidence in AMD’s techreuters.com. However, insiders caution this may merely tighten the loop: OpenAI’s stake effectively serves as a rebate, aligning its incentives with AMD’s successreuters.com. Breakingviews noted this “fantasy” arrangement gives OpenAI a massive purchase order (6 GW = ~10 million homes’ power use) plus a deep discount on AMD stockreuters.comreuters.com.

- Oracle–Stargate: Oracle has joined the AI build‑out by committing to add 4.5 GW of high-power data centers under OpenAI’s “Stargate” initiativeopenai.com. In July 2025 OpenAI announced with Oracle (and SoftBank) five new U.S. AI sites, bringing Stargate capacity to ~7 GW and investment to ~$400 billionopenai.comopenai.com. This includes three Oracle-led sites (in Texas/New Mexico/Midwest) worth >$300 billion over five yearsopenai.com. The plan emphasizes “power-first”, GPU-rich clusters (Oracle boasts systems scaling to 131,072 Nvidia GPUsdatacenterfrontier.com). Oracle has already begun delivering NVIDIA’s latest GB200 GPU racks to OpenAI’s Abilene, Texas siteopenai.comopenai.com. In the image below, the Abilene campus (Stargate I) is shown as racks of AI servers come online.openai.comopenai.com

Stargate data center (Abilene, Texas) with Nvidia GPU racks being installed by Oracle for OpenAI

These mega-deals have sent stocks gyrating. Oracle’s shares jumped ~26% on the $300B reports, driven by headlines that co-founder Larry Ellison briefly became one of the world’s richest mendatacenterfrontier.com. AMD’s stock similarly spiked – up ~30% the day the OpenAI partnership was announced, and reaching multiyear highsnasdaq.comreuters.com. Nvidia hit record highs around its OpenAI newsreuters.com. Such market moves reflect serious hype: Breakingviews quips that investors “trust in the fantasy” of AI spendingreuters.com. Indeed, OpenAI alone has now committed over $1.6 trillion to infrastructure (including Nvidia, AMD, Oracle, Microsoft, SoftBank, etc.) by 2029reuters.com – an order of magnitude above even Microsoft’s projected free cashflow. If these orders are realized, they would flood suppliers with cash; if not, they risk leaving the industry with stranded capacity (a modern echo of Cisco’s 1990s vendor-financing bubbleelnion.comreuters.com).

openai.com Massive GPU clusters are being built to train frontier AI models. Here Oracle’s Stargate site in Abilene shows rows of Nvidia GPU servers — exemplifying why analysts warn that vendor financing could “distort” true demandelnion.comreuters.com.

Broader AI Chip Landscape and Players

OpenAI’s deals highlight only part of the evolving AI hardware scene. Other giants are also jockeying for position. Microsoft continues to back OpenAI (holding 27% stake) while integrating its models into Azure, having restructured OpenAI into a public-benefit corp this yearreuters.com. Amazon Web Services (AWS) is pushing its in-house chips: AWS’s Trainium processors are being offered to OpenAI (even amid AWS’s talks to invest $10B)reuters.com. Google dominates certain AI segments with its custom TPU accelerators and has partnered with Meta to erode Nvidia’s software leadershipreuters.comreuters.com. Broadcom is working with OpenAI on custom siliconreuters.com. Meanwhile, specialized AI chip startups (Graphcore, Cerebras, SambaNova, etc.) and CPU makers (Intel’s Gaudi and forthcoming XPU efforts) are in active development, although none match Nvidia’s market share today. Even consumer-device CPUs (like Apple’s Neural Engine) and quantum/specialized architectures are part of the long-term landscape, as companies hedging future compute paths.

At the infrastructure level, dozens of cloud and data-center firms (CoreWeave, Google Cloud, AWS, Microsoft Azure, Oracle Cloud, SoftBank, etc.) are expanding GPU fleets. They compete to offer the fastest AI training. The chart below – an Oracle data-center courtyard – hints at the scale: cities of GPU servers under construction to feed the AI boom. openai.comopenai.com

openai.comopenai.com New AI data-center construction: Oracle (with OpenAI and SoftBank) has greenlit multiple multi-gigawatt sites. Above is Oracle’s Abilene facility; OpenAI and partners plan almost 10 GW of AI capacity by 2025openai.comopenai.com.

Financial and Economic Implications

These tie-ups have twisted normal market signals. Analysts warn that Nvidia’s and AMD’s reported growth may largely come from intra-company funding loops, not organic end-user demandelnion.comreuters.com. For instance, Nvidia is effectively lending to OpenAI to buy Nvidia kits, echoing Cisco’s dot-com era lending modelselnion.comreuters.com. This can inflate sales figures and stock multiples: after AMD’s deal, its forward P/E jumped above 50×nasdaq.com. Some say the warrants given to OpenAI ($0.01 share price) are akin to dumping stock into the recipient for a nominal cost, raising questions about dilution of AMD shareholderscognitmarket.comreuters.com. On the revenue side, the orders quoted (10 GW of Nvidia, 6 GW of AMD, etc.) imply hundreds of billions in chip spending. AMD itself projects $100+ billion in related revenue over four yearsreuters.com. But these figures rest on OpenAI’s seemingly infinite growth trajectory. Breakingviews notes that if OpenAI doesn’t sustain its “incredible” growth (it expects to burn ~$115 billion by 2029reuters.com), all these pre-orders could become wasted capacityreuters.com.

Investor speculation is rife. Media and analysts have repeatedly upgraded chipmakers’ stock targets post-announcement (AMD’s consensus target leaped from ~$189 to $300nasdaq.com). Yet some hedge firms caution that the hype outpaces fundamentals. Even Reuters’ tech column calls the recent deals a series of “bizarre” fantasiesreuters.com, warning that an AI bubble is inflating on paper. Stock-market moves illustrate this distortion: as Breakingviews notes, AMD’s market cap instantly rose by ~$72 billion on the newsreuters.com despite no actual hardware shipped. Oracle’s 26% one-day surge likewise reflected expectations baked into rumor rather than new earningsdatacenterfrontier.com. In sum, the financial ecosystem is skewed by roundabout funding flows – OpenAI earning equity on chip buys and tech firms tying investments to self‑purchases – making it hard to discern genuine demand versus engineered growthelnion.comreuters.com.

Regulatory and Competitive Risks

Such concentrated deals have drawn regulatory attention. U.S. agencies cleared the way in 2024 for probes into AI-sector collusion, and antitrust lawyers warn the Nvidia–OpenAI tie-up “could lock in Nvidia’s chip monopoly” and squeeze rivals like AMD or alternative AI platformsreuters.com. The Federal Trade Commission and Justice Dept. are watching; even if the current U.S. administration is more pro-businessreuters.com, a shift or foreign push could spur oversight. Oracle’s sprawling AI build-out also touches policy realms: its plan to build >100 global cloud regions (including EU “sovereign” clouds) is partly a response to tightening data/localization lawsdatacenterfrontier.com. Meanwhile, bipartisan U.S. support for domestic AI (e.g. White House pledges and subsidies) is channeling public funds toward these projects, blurring lines between market and industrial policy.

Inside companies, the fairness of these deals raises eyebrows. Giving a private startup (OpenAI) multibillion-dollar warrants in a public chipmaker (AMD) effectively transfers public shareholder value to an unelected party. Breakingviews notes this is like a “rebate” to OpenAIreuters.com. Nvidia’s own investment is similarly unconventional finance. Such structures exist in a regulatory gray zone – not direct illegal insider trading, but arguably bending norms on self-dealing. Corporate governance experts may probe whether boards exercised due diligence. At the same time, OpenAI’s unusual status (it’s now a capped-profit entity owned by a non-profit) complicates oversight: how these deals align with its original charter of public benefit is murky.

Geopolitically, the AI-chip rush is intensifying a global tech race. Export controls already limit advanced Nvidia/AMD GPUs to China, and these heavy investments reinforce U.S. dominance. Competitors like Huawei (with its own AI chips) and European/Asian chip startups may find themselves further sidelined if a few U.S. alliances corner the frontier AI market. On the positive side, these projects promise massive U.S. job and infrastructure growth (OpenAI/Oracle estimate tens of thousands of jobsopenai.com), but they also signal a tight funnel for AI leadership: success or failure by these few will have outsized effects on the whole industry.

Outlook

The emerging picture is one of high-stakes, high-risk growth. If AI compute demand truly soars, Nvidia, AMD and partners stand to cement decades of dominance – having effectively pre-sold vast future supply and funded the build-out. But if the boom slows, these leveraged arrangements could implode. Historians of tech will recall them as a possible bubble on the scale of telecoms in the 2000selnion.comreuters.com or crypto mania. Industry insiders caution that behind every bold headline lies complex financing and uncertain returns. As one analyst summarized, OpenAI and its suppliers “must simply hope that there’s method in Altman’s apparent madness.”reuters.com

Sources: Recent news and analysis from Reuters, industry reports, and OpenAI/AMD/Oracle disclosures

Leave a Reply