Beyond the Hoe: The Future of African Farming Is Smart, Automated, and Data-Driven

Why Smart Farming Matters Now

For centuries, African farming has revolved around traditional tools—the hoe, the machete, and expansive fields tended by hands. Agriculture remains the continent’s dominant employer, accounting for approximately 60% of employment in Sub-Saharan Africa . Yet, despite its centrality, productivity remains stubbornly low: crop yields are far below global averages, and post-harvest losses alone consume up to 40 % of harvests across many countries . These inefficiencies contribute to both food insecurity and lost income for smallholder farmers.

Meanwhile, farming globally is undergoing a quiet revolution. In 2025, countries across Asia, Europe, and the Americas are deploying smart farming technologies—from autonomous tractors and AI-powered drones to soil-health sensors and precision irrigation systems—turning agriculture into a data-driven, efficiency-powered sector. This shift isn’t science fiction—it’s reshaping food production now.

For Africa, this isn’t just about catching up—it’s a leapfrog moment, akin to the continent’s adoption of mobile money over traditional banking. With nearly 70% of arable land globally left uncultivated shared among African countries and agriculture contributing up to 35% of GDP in many economies , smart farming can boost food security, birth agri-tech startups, attract investment, and position African farmers in global value chains.

In short: the future of African agriculture is about more than feeding communities. It’s about building scalable businesses, driving inclusive growth, and establishing the continent as a hub for innovation. Smart farming is the gateway to that next frontier.

The Core Pillars of Smart Farming

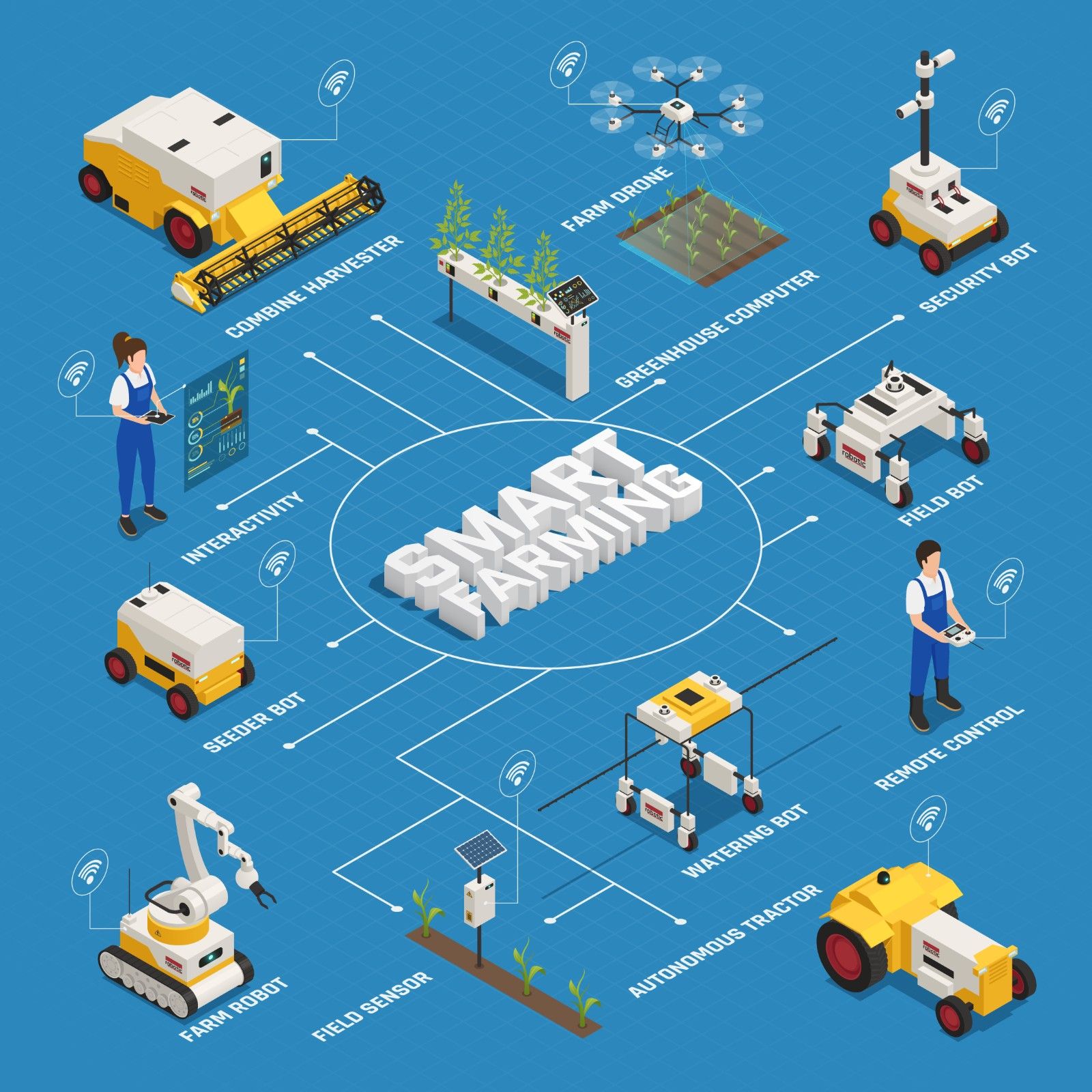

Smart farming isn’t a buzzword — it’s a system. Each component of the emerging “smart farm stack” contributes to lowering costs, boosting yields, and opening founder-friendly opportunities. The flowchart below offers a glimpse into this ecosystem, and here’s how each part plays a role in transforming African agriculture.

Smart Farming Flowchart

🚁 Farm Drones: Eyes in the Sky

Drones equipped with multispectral cameras and AI can monitor crop health, detect pest outbreaks, and even spray inputs with precision. Instead of blanket pesticide spraying, drones can target only infected areas, saving money and reducing chemical use.

- Impact: Up to 90% reduction in pesticide use and 40% faster crop monitoring compared to manual methods (mdpi.com).

- Founder play: Drone-as-a-service startups can offer subscription monitoring for smallholder cooperatives.

🚜 Autonomous Tractors: Efficiency on Wheels

Self-driving tractors use GPS and AI to plow, seed, and harvest with minimal human intervention. For African farms where labor shortages or rising wage costs are challenges, these machines can dramatically improve efficiency.

- Impact: Studies show autonomous tractors can reduce fuel consumption by 10–15% and improve productivity per hectare.

- Founder play: Leasing models for autonomous tractors, like “Uber for tractors,” could thrive in regions where farmers can’t afford ownership.

🌱 Seeder Bots: Precision from the Ground Up

Seeder bots place seeds at optimal depth and spacing, ensuring uniform growth and minimizing wasted inputs.

- Impact: Precision planting can increase yields by up to 20% while lowering seed waste.

- Founder play: Low-cost seeder bots tailored to Africa’s small plots could unlock scalable agri-tech ventures.

💧 Watering Bots: Smarter Irrigation

These robots deliver water exactly where it’s needed, preventing over-irrigation and conserving scarce resources.

- Impact: Targeted irrigation can cut water use by 30–50% (fao.org).

- Founder play: Irrigation-as-a-service startups that combine bots with solar pumps could power the next wave of African climate-tech.

📡 Field Sensors: Data Beneath the Soil

IoT sensors track soil moisture, nutrient levels, and crop growth in real time. Farmers can act before stress becomes visible.

- Impact: Optimized input use lowers fertilizer costs and boosts resilience against climate shocks.

- Founder play: Sensor-driven analytics platforms could become the “Google Analytics for African farms.”

🌿 Greenhouse Computers: Climate in a Box

Controlled environments use sensors and software to manage temperature, humidity, and light. This ensures consistent yields regardless of weather.

- Impact: Smart greenhouses can achieve yields 2–3x higher than open fields.

- Founder play: Urban agritech hubs and hydroponics startups can scale controlled farming in cities with food insecurity.

🛡️ Security Bots: Guarding the Harvest

Farm theft and crop loss remain major risks. Security bots equipped with cameras, alarms, and motion sensors deter intruders and protect assets.

- Impact: Lower losses and improved trust in large-scale farming investments.

- Founder play: Integration of farm security with insurance products could be a billion-dollar niche.

🤖 AI-Powered Farm Robots: The Hands of the Future

From robotic harvesters to weeding bots, AI robots are already replacing repetitive, labor-intensive tasks.

- Impact: Robotic harvesters can reduce labor costs by up to 40% while working 24/7.

- Founder play: African startups could localize crop-specific robots — e.g., cocoa pod pickers, cassava harvesters — to solve regional needs.

The Big Picture

Each pillar of smart farming reduces reliance on manual labor, maximizes efficiency, and generates new founder opportunities. Together, they form the “digital toolbox” for the future of African agriculture — one where data replaces guesswork, machines replace drudgery, and startups replace inefficiency with innovation.

The Data Layer: AI + IoT in the Fields

If the machines are the muscles of smart farming, data is the brain. What sets smart farming apart from traditional agriculture isn’t just automation — it’s the intelligence behind it.

🌾 Predictive Farming in Action

When drones scan fields, sensors measure soil moisture, and satellites map vegetation health, that data flows into AI models that help farmers make smarter, faster, and more precise decisions.

- Instead of reacting to drought, farmers can get alerts weeks in advance and adjust irrigation.

- Instead of blanket-fertilizing entire fields, AI can pinpoint which plots need nutrients — cutting costs and reducing runoff.

- Instead of discovering pest infestations when it’s too late, machine learning models can flag patterns early and guide targeted interventions.

This is what researchers call “predictive farming” — farming guided by forecasts and simulations, not just observation.

🛰️ The Role of Satellites, IoT, and Machine Learning

- Satellites provide macro data on weather, vegetation, and rainfall.

- IoT sensors deliver hyperlocal insights at the soil level.

- Machine learning stitches these streams together, spotting patterns humans would miss and turning raw data into actionable advice.

The result: farmers don’t just know what happened on their land — they know what’s likely to happen next.

Africa’s Data Pioneers

African startups are already proving this model works:

- Aerobotics (South Africa) uses drone imagery + convolutional neural networks (CNNs) to help fruit and nut farmers detect crop stress and pests early.

- UjuziKilimo (Kenya) combines IoT soil probes with machine learning models to predict optimal fertilizer application rates, improving yields for smallholder farmers.

Both companies show how local agri-tech can leapfrog by blending global AI tools with African realities.

🔬 Technical Spotlight: How AI Models Work in the Field

For readers with a technical background, here’s how predictive farming pipelines are often built:

- Data Inputs:

- Remote sensing data (e.g., Sentinel-2, Landsat 8, Planet Labs imagery) for vegetation indices (NDVI, EVI).

- IoT sensor data (soil moisture, pH, temperature, nutrient levels).

- Historical weather datasets (FAO, World Meteorological Organization, NASA POWER).

- AI/ML Models in Use:

- Convolutional Neural Networks (CNNs) → classify aerial images for pest detection, crop stress, or disease spread.

- Random Forests & Gradient Boosted Trees → predict yield outcomes from multi-variable datasets (soil + weather + inputs).

- Recurrent Neural Networks (RNNs)/LSTMs → forecast rainfall and crop growth patterns using sequential weather data.

- Unsupervised clustering (k-means, DBSCAN) → identify field zones for precision fertilization.

- Outputs:

- Yield prediction maps

- Fertilizer optimization recommendations

- Pest/disease alerts

- Irrigation scheduling models

This data → AI → action loop is what turns raw sensor readings into business value for farmers and startups alike.

💡 Founder & Investor Angle

For African founders, the data layer is a startup goldmine: analytics platforms, farm dashboards, and AI-driven advisory services could become the backbone of precision farming across the continent. And for investors, data-driven farming startups represent an entry point into one of Africa’s most defensible, scalable industries.

4. Smart Farming in Africa: Current Landscape 🌍🚜

Africa’s agriculture is in transition. On one hand, over 60% of Africans depend on farming for their livelihoods, yet yields remain among the lowest globally. On the other, a new wave of agri-tech startups is proving that data, automation, and smart tools can rewrite the continent’s agricultural story.

🌟 Startup Trailblazers

A few African pioneers are already setting the pace for smart farming adoption:

- Twiga Foods (Kenya) → A supply chain and logistics platform using AI to match smallholder farmers with urban markets, reducing waste and improving prices. By digitizing food distribution, Twiga has raised over $150M in funding and scaled to serve millions of consumers.

- Hello Tractor (Nigeria) → Branded as the “Uber for tractors,” it connects smallholder farmers with tractor owners through IoT-enabled devices and mobile booking. Farmers who could never afford tractors can now access mechanization on-demand, boosting productivity by up to 200%.

- Aerobotics (South Africa) → A drone and AI analytics company helping fruit and nut farmers identify crop stress, pest threats, and yield patterns. By combining aerial imaging with machine learning, Aerobotics has become one of Africa’s most sophisticated agri-tech platforms.

Together, these companies show that African agri-tech is not hypothetical — it’s real, investable, and scaling.

Regional Snapshot: Where Smart Farming is Taking Off in Africa

East Africa (Kenya, Uganda, Tanzania, Ethiopia)

- Hotspot for agri-supply chain innovation.

- Kenya leads with startups like Twiga Foods, DigiFarm, and Apollo Agriculture (AI + credit for farmers).

- Ethiopia is investing heavily in irrigation and precision farming, with state-backed pilots in smart greenhouses.

- Challenges: fragmented markets, political risk in Ethiopia/Sudan.

- Investor note: East Africa is logistics + market-access driven, making it ideal for supply-chain and fintech integrations.

West Africa (Nigeria, Ghana, Côte d’Ivoire)

- Hub of mechanization and fintech-enabled farming.

- Nigeria’s Hello Tractor is scaling tractor access; Thrive Agric provides farmer financing + insurance via digital platforms.

- Ghana is experimenting with precision cocoa farming using drones and blockchain traceability.

- Côte d’Ivoire startups are piloting AI-powered pest prediction for cocoa — a critical global commodity.

- Investor note: West Africa = biggest market size (200M+ people in Nigeria), but infrastructure gaps remain a hurdle.

Southern Africa (South Africa, Zambia, Zimbabwe)

- Strong base for hardware-heavy and drone-based solutions.

- South Africa’s Aerobotics is the poster child, with export-ready AI and drone tools for commercial orchards.

- Zambia and Zimbabwe are seeing increased interest in smart irrigation (solar + IoT).

- South Africa also benefits from stronger venture ecosystems and R&D infrastructure.

- Investor note: Southern Africa = more commercial farming, higher ability to pay, stronger exit opportunities.

Barriers Holding Back Adoption

Despite momentum, smart farming adoption faces challenges:

- Connectivity gaps: Only ~30% of rural Africa has reliable internet coverage, limiting the reach of IoT and cloud-driven tools.

- Farmer education: Many smallholders still rely on traditional practices, creating a steep learning curve for digital tools.

- Affordability: Drones, robots, and advanced sensors remain expensive relative to smallholder incomes. Without financing models, scaling adoption is difficult.

⚡ Enablers Fueling Growth

- Falling hardware costs: Drones that once cost $10,000+ now available for <$2,000, making them accessible to cooperatives and SMEs.

- Solar adoption: Solar mini-grids and panels are powering irrigation systems, sensors, and agri-robots in off-grid areas.

- Fintech integrations: Platforms like M-Pesa (East Africa) and Paystack (West Africa) make pay-as-you-go financing viable, enabling farmers to lease equipment or pay in installments.

🚀 The Bigger Picture

The African agri-tech landscape in 2025 is still early-stage, but buzzing. According to Disrupt Africa’s 2024 Agri-Tech Report, African agri-tech startups have raised over $640M cumulatively since 2016, with East and West Africa capturing the lion’s share of deals.

The message is clear: the opportunity is massive, but execution requires solving structural barriers — connectivity, financing, and farmer onboarding. The startups that crack these challenges won’t just scale across Africa; they’ll be building the blueprint for smart farming in emerging markets worldwide.

Leave a Reply